Financial Wellness: Navigating Finances for a Stress-Free Life

![]()

Money affects nearly every aspect of our lives—our choices, relationships, health, and peace of mind. When finances feel uncertain or overwhelming, stress often follows. Financial wellness is not about being wealthy; it’s about feeling secure, in control, and confident with your financial decisions.

This article explores what financial wellness truly means, why it matters, and how to build a balanced, stress-free financial life through practical and sustainable habits.

What Is Financial Wellness?

Financial wellness refers to the state of having a healthy relationship with money, where you can:

Meet current financial obligations

Feel secure about the future

Make choices that allow you to enjoy life

Handle unexpected expenses without panic

It combines knowledge, behavior, mindset, and planning—not just income level.

Why Financial Wellness Matters

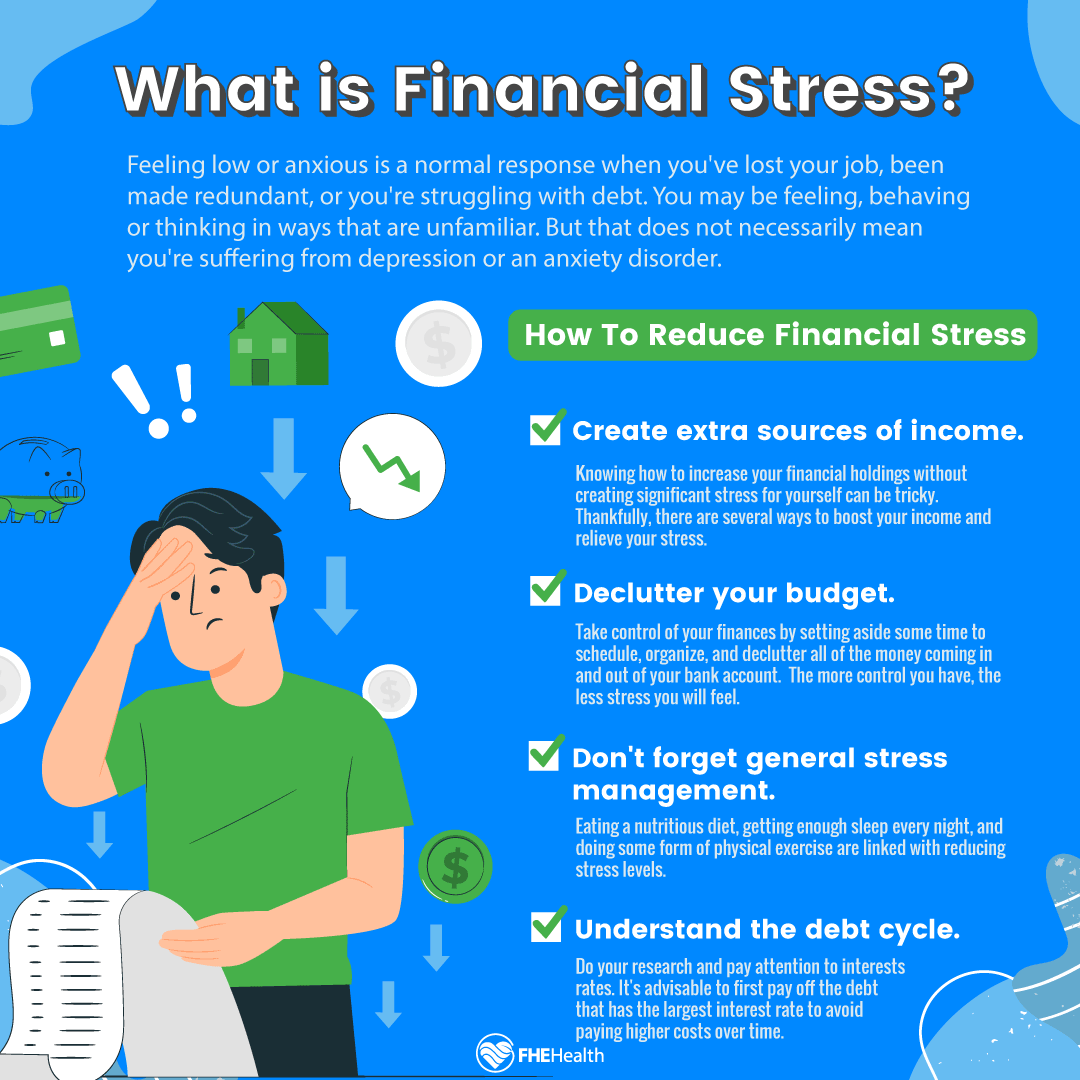

1. Reduces Stress and Anxiety

Money-related worries are a leading cause of chronic stress. Financial wellness provides clarity and control, easing mental and emotional pressure.

2. Improves Physical and Mental Health

Lower financial stress is linked to better sleep, improved focus, reduced anxiety, and healthier lifestyle choices.

3. Strengthens Relationships

Money conflicts often strain families and partnerships. Financial clarity encourages transparency, trust, and shared goals.

4. Empowers Better Life Decisions

With financial stability, you can make choices based on values rather than fear—career moves, education, travel, or entrepreneurship.

Core Pillars of Financial Wellness

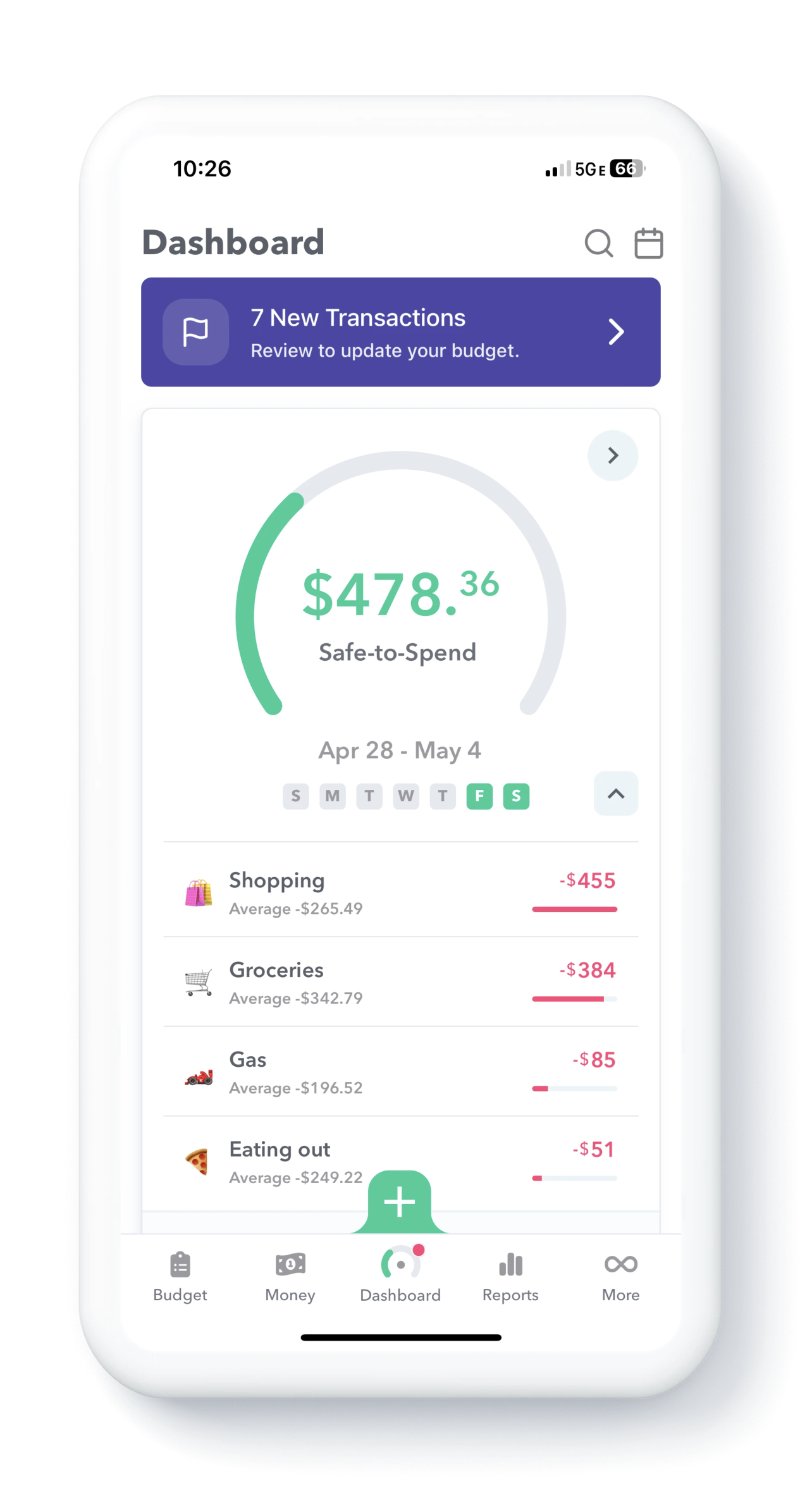

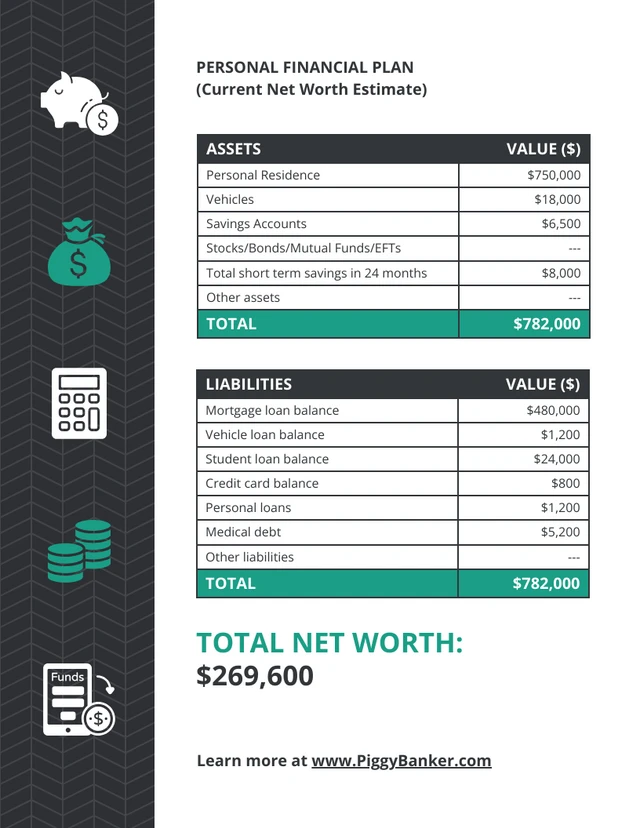

1. Financial Awareness

![]()

You can’t manage what you don’t understand.

Key Practices

Track income and expenses

Identify spending patterns

Understand fixed vs. variable costs

Know your debts and obligations

Awareness builds the foundation for every other financial decision.

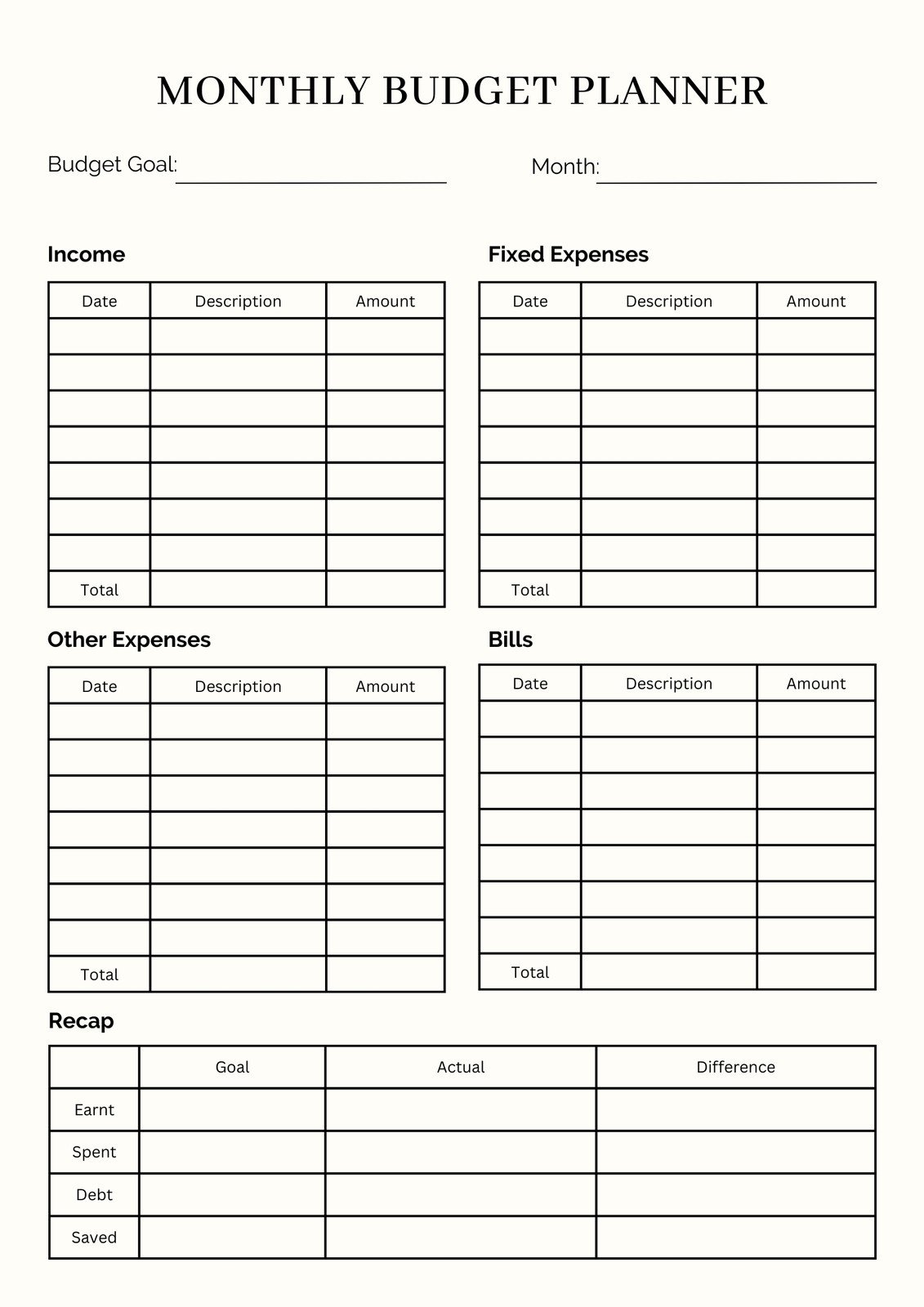

2. Budgeting Without Deprivation

Budgeting isn’t about restriction—it’s about intention.

A Healthy Budget

Covers essentials comfortably

Allows for savings and investments

Includes guilt-free spending

Adapts to life changes

A realistic budget creates freedom, not frustration.

3. Emergency Preparedness

Life is unpredictable. An emergency fund acts as your financial shock absorber.

Best Practices

Save 3–6 months of essential expenses

Keep funds easily accessible

Use only for true emergencies

This single step dramatically reduces financial anxiety.

4. Debt Management and Control

Not all debt is bad, but unmanaged debt is stressful.

Healthy Debt Habits

Prioritize high-interest debt repayment

Avoid lifestyle inflation through credit

Understand loan terms clearly

Use debt strategically, not emotionally

Reducing debt creates immediate mental relief.

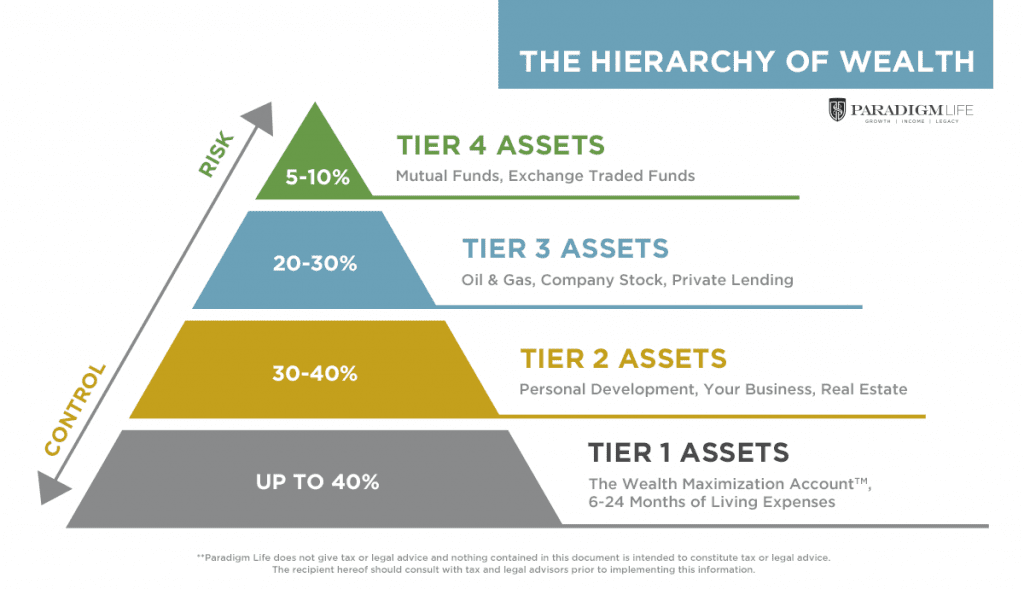

5. Saving and Investing for the Future

Financial wellness balances today’s comfort with tomorrow’s security.

Smart Financial Growth

Save consistently, even small amounts

Invest based on goals and risk tolerance

Plan for retirement early

Diversify income and investments

Time, consistency, and discipline matter more than perfection.

6. Financial Mindset and Emotional Well-Being

Your thoughts about money shape your behavior.

Healthy Money Mindset

Money is a tool, not self-worth

Progress matters more than comparison

Mistakes are learning opportunities

Financial growth is a journey

A calm, intentional mindset is the core of financial wellness.

Daily Habits That Support Financial Wellness

Small actions, repeated daily, create long-term peace:

Review expenses weekly

Automate savings

Delay impulse purchases

Educate yourself continuously

Align spending with personal values

Financial wellness grows quietly—through consistency.

Financial Wellness Across Life Stages

Early Career: Build habits, emergency fund, basic investing

Mid-Life: Balance family needs, investments, insurance, growth

Later Years: Preserve wealth, reduce risk, plan legacy

Your strategy evolves, but the goal remains the same: peace and stability.

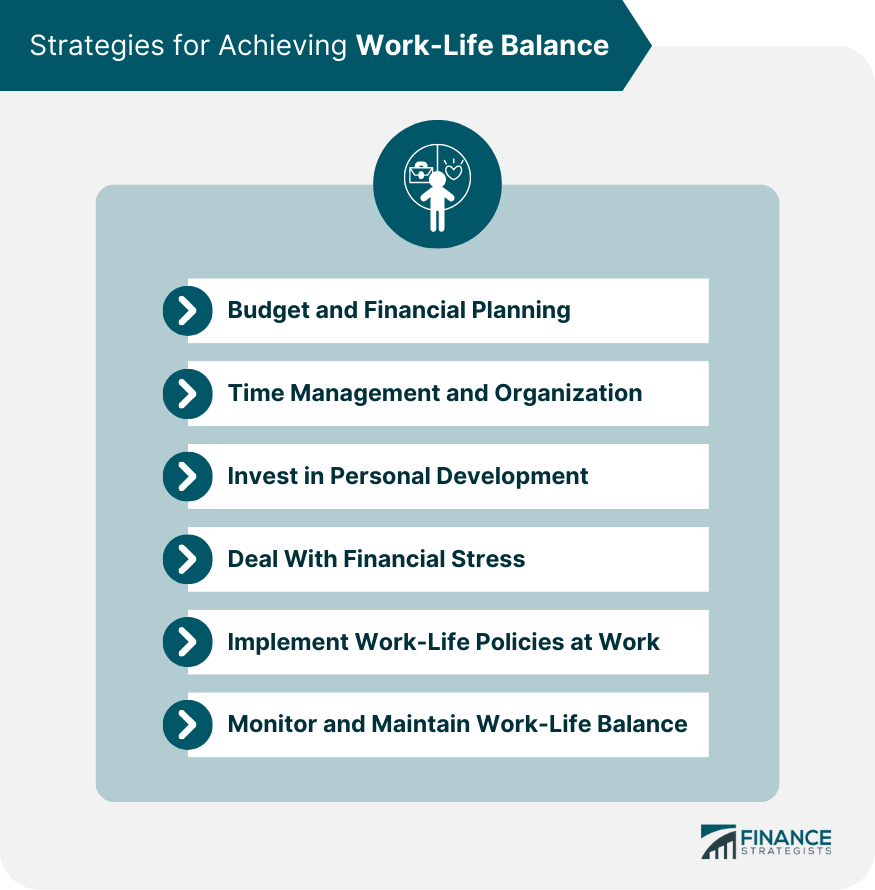

Financial Wellness and Lifestyle Balance

True financial wellness allows you to:

Enjoy experiences without guilt

Rest without financial anxiety

Take calculated risks

Focus on personal growth and health

Money becomes a support system, not a constant worry.

Common Myths About Financial Wellness

❌ “I need a high income to be financially well”

❌ “Budgeting is restrictive”

❌ “I’m too late to start”

✅ Financial wellness is about choices, habits, and mindset, not perfection or timing.

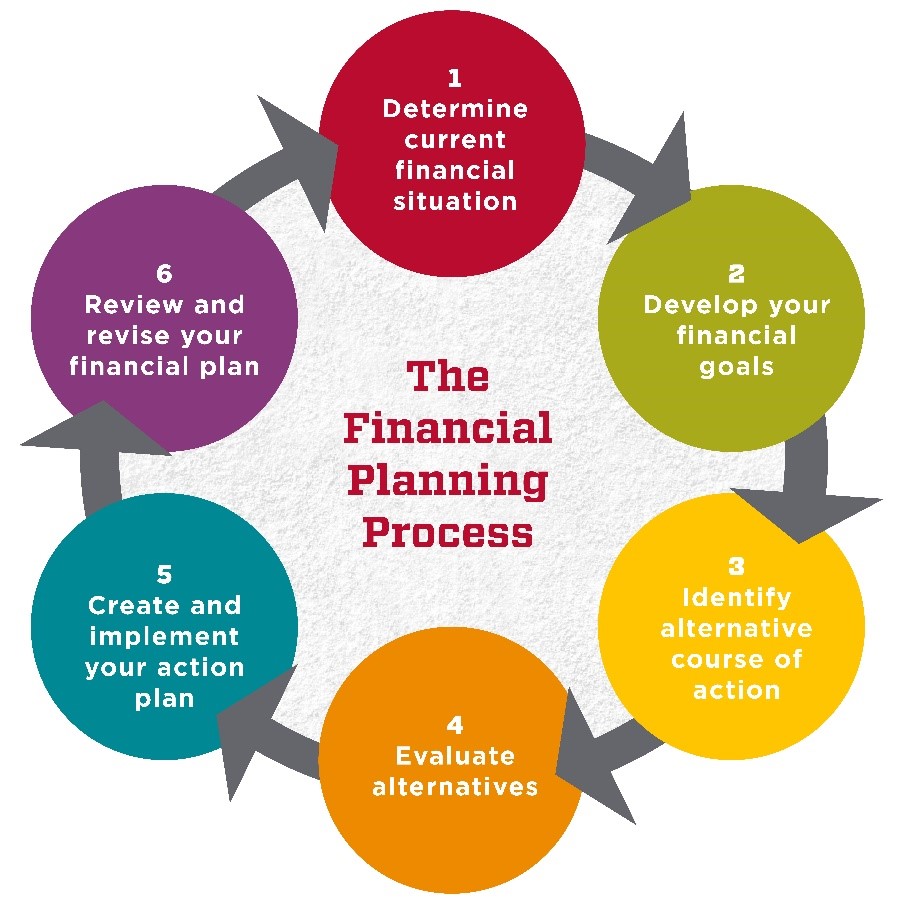

How to Begin Your Financial Wellness Journey

Understand your current financial reality

Set clear, achievable goals

Create a simple, flexible budget

Build an emergency fund

Invest in financial education

Review and adjust regularly

Progress—not speed—is what creates confidence.

Conclusion

Financial wellness is a powerful form of self-care. By developing awareness, planning intentionally, managing debt wisely, and cultivating a healthy money mindset, you can transform finances from a source of stress into a foundation of stability and freedom.

A stress-free financial life doesn’t mean having everything—it means knowing you’re prepared for what comes next.

When your finances are aligned, your life feels lighter.

Comments

Post a Comment